7.10 Taxes

Tax reports are vital for every busines because they ensure compliance with tax laws, aid in financial planning and cost management. Besides, these reports support strategic decision-making and prepare the business for audits. Via RETAIL7 system, all relevant data is accessible in the tax reports.

How a tax report can be created?

Go to My Dashboard -> Reports -> Taxes, and choose which report you would like to generate.

Taxes report

In the tax report overview the store ID, the store name, the city, the address, the country name and the sum of the tax are displayed. The records are sorted by store ID. The default setting is the current day and all stores, but you can choose other time frame and the store you need from the rolldown menus in the header.

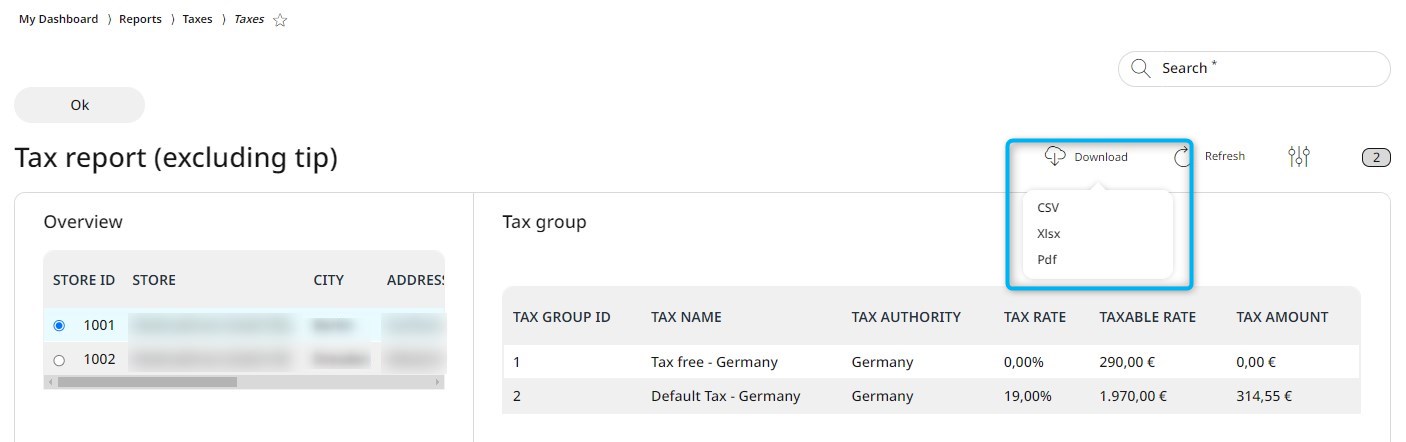

By clicking on a store and then on the View button, you can see the tax group ID, the name of the tax, the tax authority, the tax rate, the taxable rate and the tax amount collected in that particular store.

The taxes report can be downloaded directly to your system with the Download button in the header, after the appropriate file format is selected.

All taxes report

In the all taxes report you can get the tax data sorted by tax groups. In the overview you can see the tax group ID, the tax name, the tax authority, the tax rate, the taxable rate and the tax amount aggregated. The default setting is the current day and all stores, but you can choose other time frame and the store you need from the rolldown menus in the header.

The all taxes report can be downloaded directly to your system with the Download button in the header, after the appropriate file format is selected.