6.2 Datev Export

In Germany, many financial accounting programs or Datev Online directly offer the import of transaction data in Datev CSV format. This significantly facilitates accounting and the work for the tax consultant.

RETAIL7 offers the export of transaction data in this defined format.

In order to be able to use this, various settings must be made in advance - preferably together with the tax consultant.

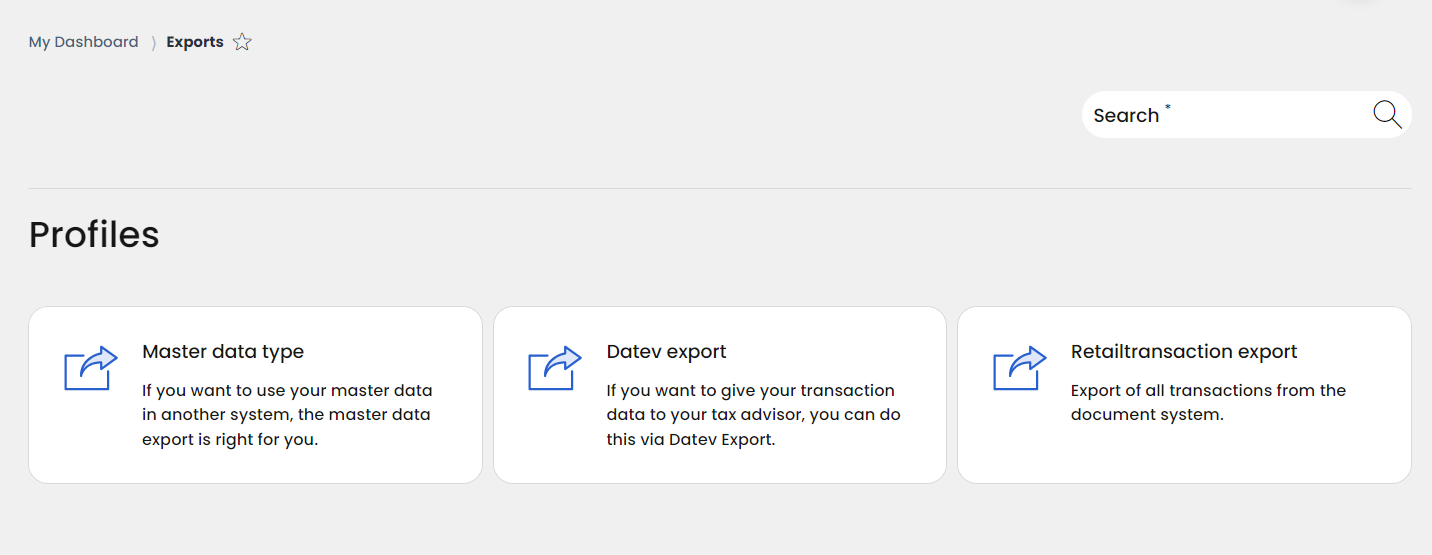

The Datev export as well as the associated settings can be found in the Management Console -> Exports -> DATEV Export.

The necessary settings are made in the menu "Header", which is located directly under the selection field, where you define the period of the transaction data to be exported.

In some cases, data is already given as a suggestion, but it is mandatory to verify it by the tax advisor. It is important to note that this does not constitute tax advice, but only shows the technical possibilities. Any consulting activity in this case is the responsibility of the tax consultant.

Field | Description |

|---|---|

Header data | Header data are the defined default values or global values for the export file. |

Consultant | Default value: 1001 This is used to store the consultant ID in the export file. |

Client | Default value: 1 This is the client ID |

G/L account number length | Default value: 4 The G/L account number length is specified by the tax advisor |

Designation | Default value: Invoice How should the transactions be named |

Dictation abbreviation | Default value: Freely definable value that identifies the origin of the data. |

Currency code | Default value: EUR Denotes the currency in which the transactions were created |

G/L account framework | Default value: 04 Each farm is managed according to a G/L account framework defined by the tax advisor. As a rule, it is 04 or 03 |

Origin | Default value: RE Abbreviation |

Fixation | Default value: 1 |

Stack of bookings | defines the default accounts |

Cash account | Default value: 1000 Defines which posting account should be used for the cash register. |

Change account | Default value: 1360 Defines which posting account is to be used for the change |

Deposit account | Default value: 1360 Defines which posting account should be used for deposits |

Disbursement account | Default value: 1360 Defines which posting account should be used for disbursements |

Skimming account | Default value: 1360 Defines which ledger account should be used for skimmings. Skimmings are intraday cash withdrawals from the cash register to reduce the cash balance. |

Different means of payment in one transaction | Defines which posting account should be used if there is a use of several different means of payment in one transaction and therefore no clear assignment is possible. |

Tip account | Defines which booking account should be used for tips |

Tax account assignment | For each valid tax group a tax account must be specified. In Germany, these are at least the standard tax rate (currently 19%), the reduced tax rate (currently 7%) and tax-free. In special cases, other tax rates are also valid; please consult your tax consultant. These can also be added for your RETAIL7 environment. |

Means of payment | Default values: BAR 1000, EFT 12000 Each means of payment must be assigned to a G/L account, otherwise it will not appear in the export. Additional means of payment can be flexibly assigned to the system. Our support will be happy to help you with this. |

Tax free account | Default value: 8100 A complete transaction can be defined as tax free by function. This is intended for a wide variety of use cases. |

Save as default | Default value: active Your entered values will be stored permanently, if this option is active, so that the values do not have to be stored again and again. |

Once again, it should be mentioned that the RETAIL7 system does not / may not provide tax advice. This is the exclusive responsibility of tax consultants. We are happy to assist with the technical configuration.